Free Section 125 Plan Document Template

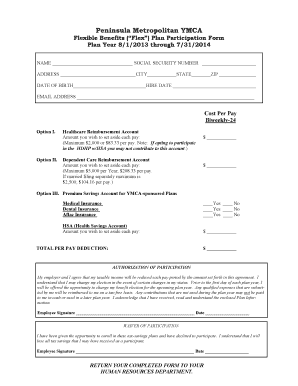

Free section 125 plan document template - The Plan is intended to qualify as a Cafeteria Plan under Section 125 of the Code so that Optional. The Section 125 Premium Only Plan is part of the IRS Code that allows employees to purchase health insurance and other ancillary benefits tax free. This document is intended as a. Step by Step in 5-10 Minutes. Premium Only Plan effective April 1 2014. Instantly Find Download Legal Forms Drafted by Attorneys for Your State. We Help You Stay In Compliance Many companies have a Section 125 POP plan document on file but it is out of date. The purpose of the plan is to allow employees the opportunity to elect to pay the portion of medical insurance premium costs for which they are responsible either on a pre-salary reduction basis or. After all the whole point of setting up a Section 125 plan is to save money by eliminating income tax on insurance premiums. Sounds good at first.

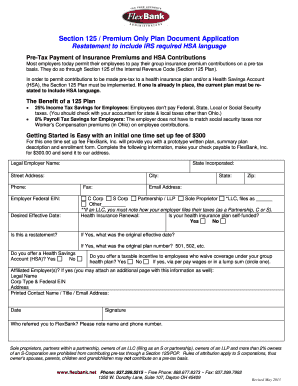

Ad The Leading Online Publisher of National and State-specific Legal Documents. Section 125 Plan Document Template. The premium or HSA contribution is actually deducted before taxes are calculated. A Flexible Benefit Plan also known as a Section 125 Plan is part of a cafeteria plan that allows employees to purchase certain benefits with pretax dollars. Although most cafeteria plan documents include HIPAA special enrollment rights under Code Section 9801f many plans likely do not allow for a 60-day election period.

Section 125 Plan Document Template Fill Online Printable Fillable Blank Pdffiller

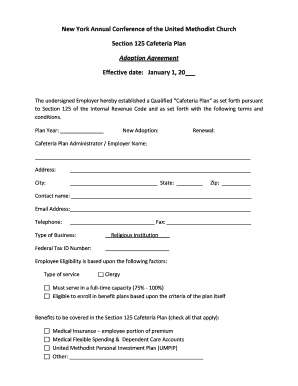

Section 101 PLAN This document Basic Plan Document and its related Adoption Agreement are intended to qualify as a premium only cafeteria plan within the meaning of Code section 125 that provides for the pre-tax payment of premiums and to the extent provided in the Adoption Agreement pretax contributions to a Health Savings Account. SAMPLE PLAN DOCUMENT SECTION 125 FLEXIBLE BENEFIT PLAN Version 0117 The attached plan document and adoption agreement are being provided for illustrative purposes only. Because of differences in facts circumstances and the laws of the various states interested parties should consult their own attorneys.

Section 125 Plan Document Requirements Fill Online Printable Fillable Blank Pdffiller

Section 101 PLAN This document Basic Plan Document and its related Adoption Agreement are intended to qualify as a premium only cafeteria plan within the meaning of Code section 125 that provides for the pre-tax payment of premiums and to the extent provided in the Adoption Agreement pretax contributions to a Health Savings Account. Legally Binding Contracts Online. Instantly Find Download Legal Forms Drafted by Attorneys for Your State.

Scgov Net

To the extent provided in the Adoption Agreement the Plan provides for the pre-tax payment of premiums and contributions to spending accounts that are excludable from gross. Section 101 PLAN This document Basic Plan Document and its related Adoption Agreement are intended to qualify as a cafeteria plan within the meaning of Code section 125. Ad Simple Legal Solutions in the Comfort of Your Home.

Quitmanschools Org

The Plan is intended to qualify as a Cafeteria Plan under Section 125 of the Code so that Optional. Section 101 PLAN This document Basic Plan Document and its related Adoption Agreement are intended to qualify as a cafeteria plan within the meaning of Code section 125. Ad Simple Legal Solutions in the Comfort of Your Home.

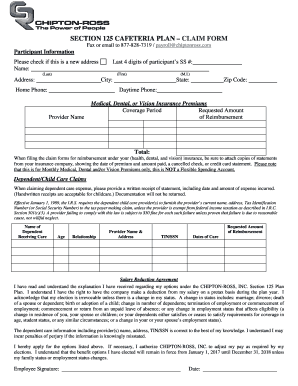

Fillable Online Fsa Reimbursement Claim Form Section 125 Cafeteria Plan Fax Email Print Pdffiller

These documents explain the rules of the plan. Section 125d2A states that the term cafeteria plan does not include any plan which provides for deferred compensation. Free 18 Individual Development Plan Examples Samples In Pdf Word Google Docs Pages Doc Examples.

Beware Of Free Or Self Serve Section 125 Plan Documents Core Documents

These documents explain the rules of the plan. To the extent provided in the Adoption Agreement the Plan provides for the pre-tax payment of premiums and contributions to spending accounts that are excludable from gross. FSA-City of Boston Enrollment-Form For OPEN Enrollment Use Only.

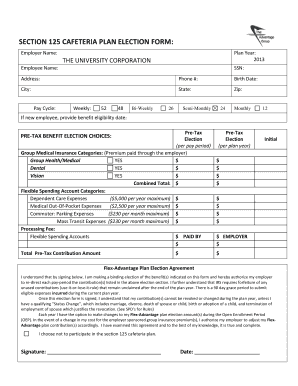

Fillable Online Csun Section 125 Cafeteria Plan Election Form California State Csun Fax Email Print Pdffiller

Step by Step in 5-10 Minutes. PREMIUM ONLY PLAN DOCUMENT. Sample Plan Document.

Fillable Online Section 125 Cafeteria Plan Claim Form Chipton Ross Fax Email Print Pdffiller

Jason September 27 2021 wallpaper No Comments. Instantly Find Download Legal Forms Drafted by Attorneys for Your State. The purpose of the plan is to allow employees the opportunity to elect to pay the portion of medical insurance premium costs for which they are responsible.

Scgov Net

Sounds good at first. A cafeteria plan must have a plan year specified in the written plan document. The purpose of the plan is to allow employees the opportunity to elect to pay the portion of medical insurance premium costs for which they are responsible either on a pre-salary reduction basis or.

Sample Section 125 Plan Document Fill And Sign Printable Template Online Us Legal Forms

The purpose of the plan is to allow employees the opportunity to elect to pay the portion of medical insurance premium costs for which they are responsible. Section 101 PLAN This document Basic Plan Document and its related Adoption Agreement are intended to qualify as a cafeteria plan within the meaning of Code section 125. Although most cafeteria plan documents include HIPAA special enrollment rights under Code Section 9801f many plans likely do not allow for a 60-day election period.

Section 12 Purpose The purpose of the Plan is to provide Participants with a choice between cash and certain qualified nontaxable benefits as defined in Section 125 of the Internal Revenue Code. After all the whole point of setting up a Section 125 plan is to save money by eliminating income tax on insurance premiums. This document is intended as a. Jason September 27 2021 wallpaper No Comments. These documents explain the rules of the plan. Section 125 cafeteria plan create your required section 125 cafeteria plan document with flexible spending account health savings account dependent care account pre tax premium deductions permitted in easy to follow steps strategic plan template free download cascade strategy the strategic plan template will help you to create all the elements of a strategic plan and by the end you will have a. Ad Free Fill in Legal Templates. As is the case with our sample cafeteria plan documents since past special enrollment rights had only a 30-day timeframe. Federal law requires all employers to have a 125 Cafeteria Premium Only Plan POP document if offering tax free benefits to their employees. Create a Personalized Legal Document in Minutes.

The purpose of the plan is to allow employees the opportunity to elect to pay the portion of medical insurance premium costs for which they are responsible either on a pre-salary reduction basis or. FSA-Enrollment-Authorization Form This is a generic form call CPA Inc if you need information on your plan specs. Premium Only Plan It is the intent that this plan shall qualify as a Section 125 plan of IRC as amended from time to time. Although most cafeteria plan documents include HIPAA special enrollment rights under Code Section 9801f many plans likely do not allow for a 60-day election period. A cafeteria plan must have a plan year specified in the written plan document. With a Section 125 POP plan each eligible employee is given the option to elect into a Salary Reduction Agreement with the employer in which he or she agrees to the amount of pre-tax salary to be witheld from wages for health care coverage. Ad Simple Legal Solutions in the Comfort of Your Home. The plan document for a. The plan document should be signed and kept on file. To the extent provided in the Adoption Agreement the Plan provides for the pre-tax payment of premiums and contributions to spending accounts that are excludable from gross.

Section 125 Plan Document Template. Trusted by Over 10 Million People. Basic Business Plan Template 18 Free Pdf Format Download Free Premium Templates. Section 125d2A states that the term cafeteria plan does not include any plan which provides for deferred compensation. The premium or HSA contribution is actually deducted before taxes are calculated. This sample form Section 125 Cafeteria Plan Summary Plan Document SPD is an important document which should be carefully considered in light of the Employers particular circumstances. The Plan Document governs in the event of any discrepancy between these documents. Section 125 cafeteria plan create your required section 125 cafeteria plan document with flexible spending account health savings account dependent care account pre tax premium deductions permitted in easy to follow steps strategic plan template free download cascade strategy the strategic plan template will help you to create all the elements of a strategic plan and by the end you will have a. FSA-City of Boston Enrollment-Form For OPEN Enrollment Use Only. A Flexible Benefit Plan also known as a Section 125 Plan is part of a cafeteria plan that allows employees to purchase certain benefits with pretax dollars.