Free Printable 1099 Form

Free printable 1099 form - Form 1099-NEC as nonemployee compensation. Form 1099 is used to report income to the Internal Revenue Service IRS and to the individual receiving the income. This income is also subject to a substantial additional tax to be reported on Form 1040 1040-SR or 1040-NR. The list of payments that require a business to file a 1099-MISC form is featured below. Any amount included in box 12 that is currently taxable is also included in this box. See the Instructions for Forms 1040 and 1040-SR or the Instructions for Form. On our website you can get a tax form 1099 printable. Department of the Treasury - Internal Revenue Service. Starting with the tax year of 2020 a 1099-MISC Form is meant to be filed for every person ie. A 1099-NEC Form is now the appropriate form.

For State Tax Department. Non-employee you have paid over 600 for an assorted list of miscellaneous business payments.

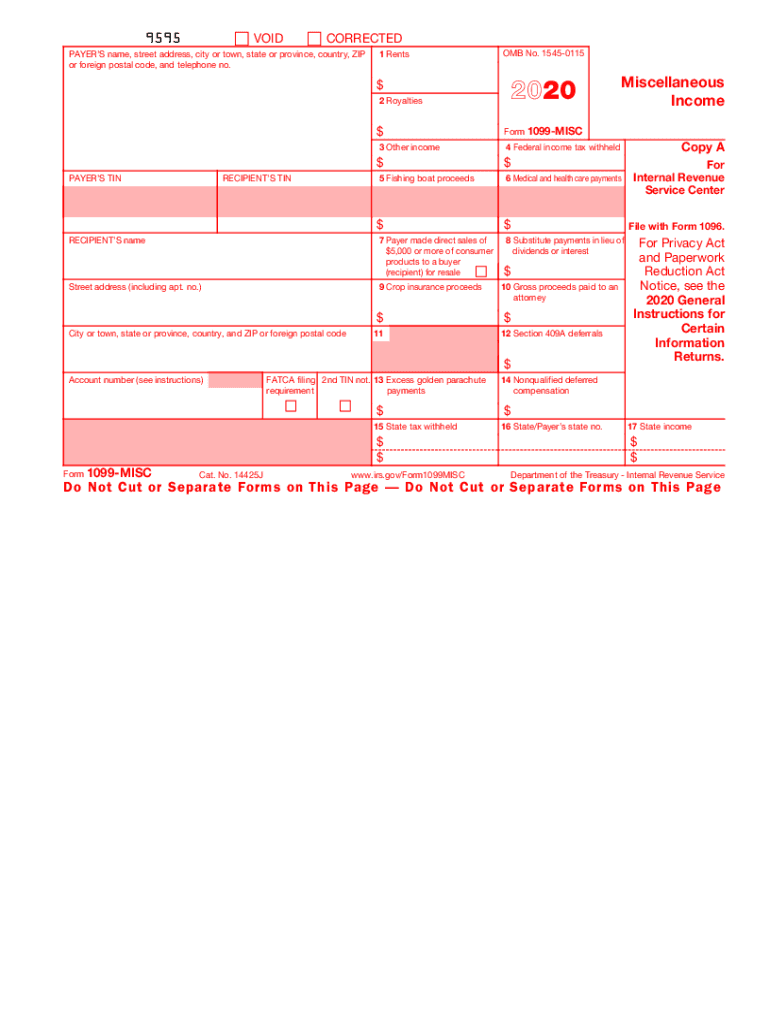

Printable Form 1099 Misc 2021 Insctuctions What Is 1099 Misc Tax Form

Any amount included in box 12 that is currently taxable is also included in this box. The list of payments that require a business to file a 1099-MISC form is featured below. Department of the Treasury - Internal Revenue Service.

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

For State Tax Department. On our website you can get a tax form 1099 printable. Department of the Treasury - Internal Revenue Service.

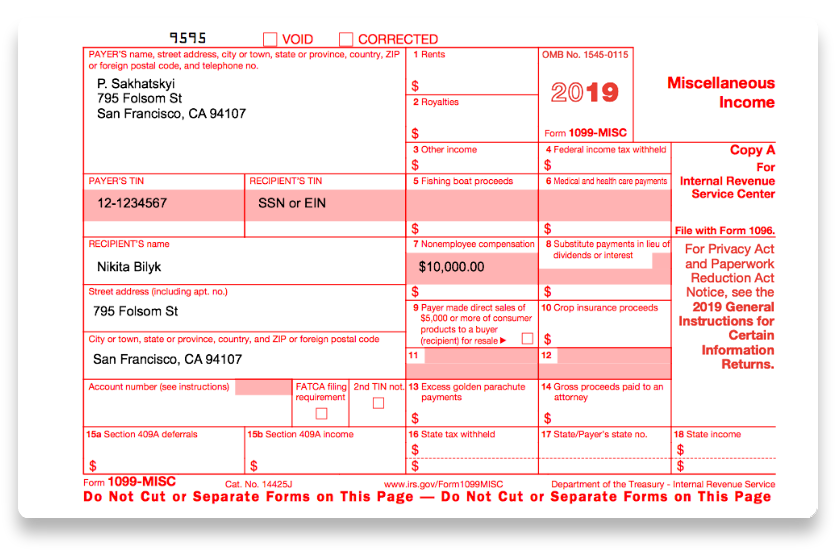

Free Fillable 1099 Misc Form 2019

See the Instructions for Forms 1040 and 1040-SR or the Instructions for Form. For State Tax Department. Form 1099 is used to report income to the Internal Revenue Service IRS and to the individual receiving the income.

2020 Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

Non-employee you have paid over 600 for an assorted list of miscellaneous business payments. Starting with the tax year of 2020 a 1099-MISC Form is meant to be filed for every person ie. For State Tax Department.

1099 Form 2021 Printable Fillable Blank

Non-employee you have paid over 600 for an assorted list of miscellaneous business payments. Form 1099-NEC as nonemployee compensation. See the Instructions for Forms 1040 and 1040-SR or the Instructions for Form.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.01.40PM-9e232e8b991047fabfe3041a51889486.png)

Fillable 1099 Misc Form Fill Online Download Free Zform

For State Tax Department. Form 1099 is used to report income to the Internal Revenue Service IRS and to the individual receiving the income. The list of payments that require a business to file a 1099-MISC form is featured below.

Irs 1099 Misc Form Pdffiller

For State Tax Department. Non-employee you have paid over 600 for an assorted list of miscellaneous business payments. A 1099-NEC Form is now the appropriate form.

1099 Form 2019 Pdf Fillable

Department of the Treasury - Internal Revenue Service. The list of payments that require a business to file a 1099-MISC form is featured below. Any amount included in box 12 that is currently taxable is also included in this box.

Tax 1099 Form 2019 1099 Form 2021 Printable

Starting with the tax year of 2020 a 1099-MISC Form is meant to be filed for every person ie. See the Instructions for Forms 1040 and 1040-SR or the Instructions for Form. Form 1099 is used to report income to the Internal Revenue Service IRS and to the individual receiving the income.

How To Fill Out Irs 1099 Misc 2019 2020 Form Pdf Expert

A 1099-NEC Form is now the appropriate form. Form 1099 is used to report income to the Internal Revenue Service IRS and to the individual receiving the income. On our website you can get a tax form 1099 printable.

This income is also subject to a substantial additional tax to be reported on Form 1040 1040-SR or 1040-NR. Non-employee you have paid over 600 for an assorted list of miscellaneous business payments. Form 1099 is used to report income to the Internal Revenue Service IRS and to the individual receiving the income. For State Tax Department. On our website you can get a tax form 1099 printable. A 1099-NEC Form is now the appropriate form. Starting with the tax year of 2020 a 1099-MISC Form is meant to be filed for every person ie. Form 1099-NEC as nonemployee compensation. Any amount included in box 12 that is currently taxable is also included in this box. See the Instructions for Forms 1040 and 1040-SR or the Instructions for Form.

Department of the Treasury - Internal Revenue Service. The list of payments that require a business to file a 1099-MISC form is featured below.